Assuming equal risk, you should buyĭ) neither the expenses are too high. The index fund had an annual return of 12% and expenses of 1%. The growth stock fund had an annual return of 15% and expenses of 2%. If the fund NAV appreciates to $28 by the time you sell it on December 31, what was your return on investment?ĭ) 14% b You are considering investing in a no-load mutual fund that focuses on growth stocks or in an index fund.

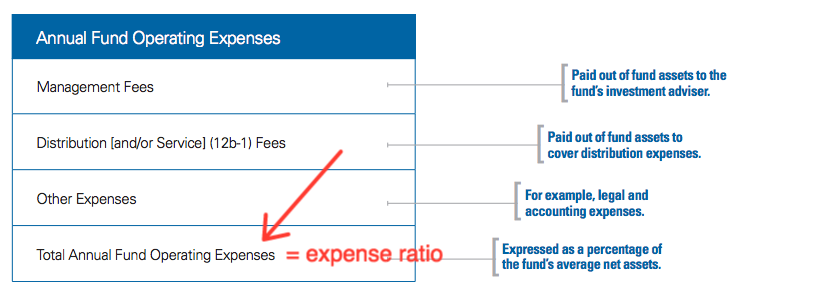

a On January 1, you invest $10,000 in an open-end mutual fund selling for $25 per share that has a 2% load, 1.5% management fee and 1% 12b-1 expense s. d When evaluating mutual funds which are investing in the same types of securities/markets, you should compareĭ) All of these factors should be considered. If you sell your shares at an NAV of $24 per share, what is the return on your investment?ĭ) 10.8% c If a mutual fund's NAV is $50 and its expense ratio is 2%, what are the total expenses per share?ĭ) $5 d How much money would you need to purchase 400 shares of a mutual fund with an NAV of $55 per share and a 3% load?ĭ) $22,660 c Which of the following is not a characteristic of a closed-end mutual fund?Ī) Once the fund closes the shares of the fund trade on the stock market just like a stock.ī) The shares may sell above NAV on the secondary market.Ĭ) Investors can easily sell their share back to the fund on a daily basis at NAV.ĭ) The shares may sell below NAV on the secondary market. If 10 million shares are outstanding, what is the NAV?ĭ) $12.50 b You invested $1,000 in a mutual fund with a 4% load when the NAV was $20 per share. c A mutual fund has a beginning balance of $100 million, earns interest of $10 million, receives dividends of $15 million, and has expenses of $5 million. b The component of expense ratios that includes a fee charged by some mutual funds to pay brokers isĭ) a referral fee.

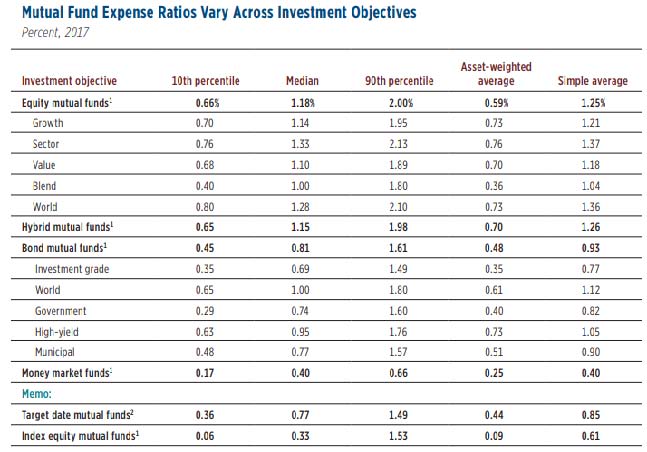

c The amount by which a closed-end fund's share price in the secondary market is below the fund's NAV is called theĭ) par value. a Which of the following expenses is usually the highest for a mutual fund?ĭ) Referral fees b The amount by which a closed-end fund's share price in the secondary market is above the fund's NAV is called theĭ) par value. a On the average, actively managed mutual funds have an expense ratio of aboutĭ) 5%. b Regarding load and no-load mutual funds,Ī) load funds usually outperform no-load funds.ī) no-load funds perform at least as well as load funds even when the fees are ignored.Ĭ) the two types of funds perform about the same considering the fees.ĭ) load funds may be bought directly, whereas no-load funds must be purchased through a broker.

c Stock brokers typically do not recommend no-load funds becauseĪ) the return is lower than on load funds and brokers want to sell only the best funds to their clients.ī) federal law prohibits brokers from selling no-load funds.Ĭ) no-load funds do not pay a fee to the broker for selling them.ĭ) there is no secondary market for them. a Which of the following characteristics is not true of closed-end funds?ī) They do not repurchase shares from investors.Ĭ) They are bought and sold on stock exchanges.ĭ) They may sell above or below NAV. C Existing shares of closed-end mutual fund companies are purchasedī) from the investment company through a broker.Ĭ) from other investors in the stock market.ĭ) from a bank.

0 kommentar(er)

0 kommentar(er)